- The Japanese Yen rallied on Wednesday amid speculations of another intervention by authorities.

- The momentum, however, runs out of steam on the back of the divergent BoJ-Fed policy outlooks.

- Traders now look to the second-tier US data for some impetus ahead of the NFP report on Friday.

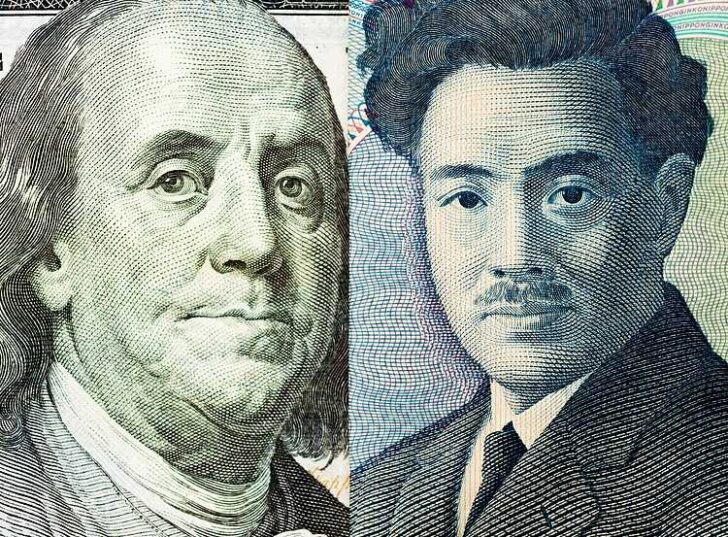

The Japanese Yen (JPY) comes under heavy selling pressure during the Asian session on Thursday and retreats further from over a two-week high touched against its American counterpart the previous day. The initial reaction to speculations that Japanese authorities intervened again, for a second time this week, to prop up the domestic currency fades rather quickly amid bets that the US-Japan rate differential will remain wide for some time. This, along with a generally positive risk tone around the US equity markets, turn out to be key factors undermining the safe-haven JPY.

The US Dollar (USD), on the other hand, regains positive traction in the wake of a fresh leg up in the US Treasury bond yields, bolstered by the Federal Reserve’s (Fed) hawkish signal that interest rates will remain higher for longer. This is seen as another factor that contributes to the USD/JPY pair’s bid tone near the 156.00 mark. Traders now look to the US macro data – Challenger Job Cuts, the usual Weekly Initial Jobless Claims and Trade Balance data for some impetus later this Thursday, though the focus will be on the popularly known US Nonfarm Payrolls (NFP) report on Friday.

Daily Digest Market Movers: Japanese Yen fades the previous day’s possible intervention-led strong rally

A likely Japanese Yen buying directed by Japan’s Ministry of Finance triggered a steep USD/JPY decline to over a two-week low during the late US session on Wednesday, though the momentum falters near the 153.00 mark.

Japan’s top currency diplomat Masato Kanda declined to confirm if authorities had stepped into the FX market to support the domestic currency and said that they will disclose intervention data at the end of this month.

Minutes of the Bank of Japan March policy meeting revealed this Thursday that the central bank must continue to support the economy from a financial standpoint to achieve sustained, domestic demand-driven recovery.

The lack of change in forward guidance by the Federal Reserve on Wednesday, signaling that it is leaning toward reductions in borrowing costs later this year, was perceived as dovish and led to the overnight US Dollar slump.

In the post-meeting press conference, Fed Chair Jerome Powell noted that inflation has eased substantially over the past year but it’s still too high and that further progress on inflation is not assured as the path is uncertain.

Fed fund futures traders are now pricing in 35 basis points of easing this year, up from 29 bps before the statement, which is still less than three 25 bps cuts projected by the US central bank and helps revive the USD demand.

A positive tone around the US equity markets further contributes to driving flows away from the safe-haven JPY and provides an additional boost to the USD/JPY pair on Thursday ahead of the second-tier US economic releases.

The market attention, meanwhile, remains on the US jobs report on Friday, which will now play a key role in influencing the near-term USD price dynamics and provide some meaningful impetus to the currency pair.

Technical Analysis: USD/JPY bulls need to wait for move beyond 50% Fibo., near 156.50 before placing fresh bets

From a technical perspective, the overnight bounce from the 200-period Simple Moving Average on the 4-hour chart and the subsequent move beyond the 38.2% Fibonacci retracement level of this week’s sharp pullback from a multi-decade high favor bullish traders. That said, mixed oscillators on hourly/daily charts warrant some caution before positioning for any further intraday appreciating move, suggesting that the USD/JPY pair might confront some resistance near the 50% Fibo. level, around the 156.55 region. Some follow-through buying, however, will suggest that the recent corrective slide from the all-time peak has run its course and pave the way for additional gains.

On the flip side, weakness back below the 155.70 area could drag the USD/JPY pair back towards the 155.00 psychological mark en route to the 154.50-154.45 support zone. Failure to defend the latter might expose the Asian session low, around the 153.00 round figure, with some intermediate support near the 154.00 mark and the 153.60 region.

Leave a Reply