- The Japanese Yen drifts lower for the second straight day and is pressured by a combination of factors.

- The BoJ’s cautious stance, softer domestic data and a positive risk tone undermine the safe-haven JPY.

- The upbeat US NFP-inspired USD strength lifts the USD/JPY pair back closer to the multi-decade high.

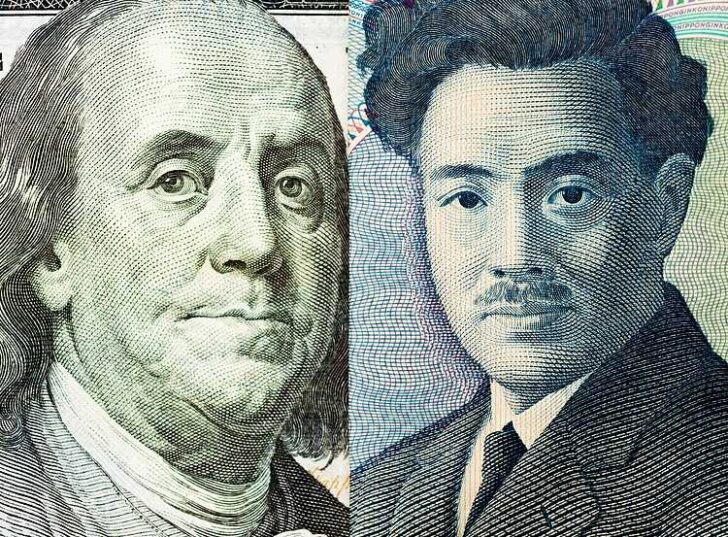

The Japanese Yen (JPY) kicks off the new week on a weaker note and retreats further from over a two-week high touched against its American counterpart on Friday. The Bank of Japan’s (BoJ) dovish language, signaling that the next rate hike will be some time away, along with a positive risk tone, continues to undermine the safe-haven JPY. Apart from this, softer domestic data, showing that real wages in Japan fell in February for the 23rd consecutive month, drags the JPY lower for the second straight day.

The US Dollar (USD), on the other hand, remains supported by the upbeat US jobs report released on Friday, which suggested the Federal Reserve (Fed) may delay cutting interest rates. Furthermore, reduced bets for three Fed rate cuts in 2024 remain supportive of elevated US Treasury bond yields. The resultant widening of the US-Japan rate differential further weighs on the JPY, which assists the USD/JPY pair to build on Friday’s bounce from over a two-week low and climb back closer to a multi-decade high.

That said, the recent jawboning from Japanese authorities, showing readiness to intervene in the markets to prop up the domestic currency, might hold back the JPY bears from placing aggressive bets. Investors might also prefer to move to the sidelines ahead of this week’s key release of the latest US consumer inflation figures and the FOMC meeting minutes on Wednesday. This, in turn, warrants caution before positioning for the resumption of the recent uptrend witnessed over the past four weeks or so.

Daily Digest Market Movers: Japanese Yen remains on the back foot against USD amid divergent BoJ-Fed expectations

- The Bank of Japan’s (BoJ) cautious approach towards further policy tightening, along with softer wage data from Japan, dragged the Japanese Yen lower for the second straight day on Monday.

- The Bank of Japan struck a dovish tone at the end of the March monetary policy meeting and stopped short of offering any guidance about future steps, or the pace of policy normalization.

- The labor ministry reported that Japanese workers’ inflation-adjusted real wages fell by 1.3% in February from a year earlier as compared to the previous month’s revised decline of 1.1%.

- Data published by the Ministry of Finance showed Japan’s current account rose to 2.64 trillion Yen in February, the highest since October last year, though was below consensus estimates.

- Reports that progress has been made in Gaza ceasefire talks boost investors’ confidence and turn out to be another factor that undermines demand for the safe-haven JPY.

- Japanese government officials continued with their jawboning to defend the domestic currency, albeit doing little to impress the JPY bulls or hinder the USD/JPY pair’s move up.

- The US Dollar draws support from the upbeat US jobs data released on Friday, which forced investors to trim their bets for a June interest rate cut by the Federal Reserve.

- The popularly known NFP report showed that the US economy added 303K jobs in March and the unemployment rate fell to 3.8% from 3.9% in the previous month.

- The data, meanwhile, gives the Fed more reason to stay patient and changed the odds of rate cuts this year from three to two, which pushes the US Treasury bond yields higher.

- The market focus now shifts to the release of the US consumer inflation figures for March, due on Wednesday, which will be followed by the FOMC meeting minutes.

- Investors will look for more cues on potential Fed rate cuts in 2024 before positioning for the next leg of a directional move for the buck and the USD/JPY pair.

Technical Analysis: USD/JPY bulls not ready to give up yet, flirt with multi-decade top below the 152.00 mark

From a technical perspective, bulls might still wait for sustained strength and acceptance above the 152.00 mark before placing fresh bets. Given that oscillators on the daily chart are holding in the positive territory and are still away from being in the overbought zone, the USD/JPY pair might then resume its uptrend witnessed over the past month or so from the March trough.

On the flip side, the 151.30 horizontal zone now seems to protect the immediate downside ahead of the 151.00 mark. Some follow-through selling will expose Friday’s swing low, around the 150.30 region. This is followed by the 150.00 psychological mark, which if broken decisively will shift the near-term bias in favor of bearish traders. The USD/JPY pair might then slide to the 149.35-149.30 region en route to the 149.00 mark.

Leave a Reply